Taxes on your Cryptocurrency Trades are Here!

Sorry U.S. Citizens, thanks to the new tax bill signed into law just before Christmas you are now required to track every single cryptocurrency trade you make, calculate the profit and loss and keep a record of 'ALL' activity so that your uninvited partner, uncle Sam and his enforcer, the IRS (World Bank & IMF) can take their cut of your activity. Between trade profits and value appreciation that could be quite significant. If you are a frequent trader it's a book keeping nightmare.

But you knew it was coming, right? Previously such transactions were considered commodities and subject to the 1031 exchange exemption, whereby exchanges of like kind (property A for property B) were exempt from capital gains taxes. Not any more.

Here's one article where you can read some details. I don't need to rehash it all here.

My point is simple, cryptocurrencies are here to stay and being such, they are on the road to regulation and taxation. Simple. And with the explosive growth of this 'space' in the markets, do you think your uncle is going to let this opportunity for huge graft slip through his fingers without him getting his piece? That chunk being paid to your uninvited partner could be quite substantial.

Where will that money do more good? With your 'uncle' Sam? Or maybe with your family? Uh huh!

There are solutions to this though where you can render the new law meaningless and have no fear of any negative repercussions. (Of course there is or I wouldn't be bringing it up, right?)

Solution #1:

Learn to change your legal status and remove the IRS from your life entirely. You can learn how to do this in the Lighthouse Law Club. It's very simple. It's not complicated and anyone can do it with no risk of any kind. Join as a Constitutional Commando member.

Solution #2:

Learn to work with an international business trust. The trust itself is 'foreign' to the U.S. It trades in Euro as the base currency, not USD so there are no USD profits. It is completely outside the jurisdiction of your uncle's 'enforcers' and they have no relationship, obligation to your uncle whatsoever. Learn more about that here.

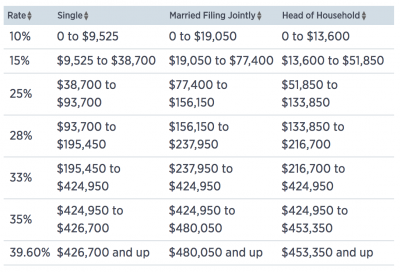

If neither of those options suit you, then, for your convenience, we've posted the new tax brackets here below. You can evaluate what your bill might be and then you can think about how you're going to keep track of all your trades!

Best Wishes for a profitable new year in any event!